Financing Your Modular Project

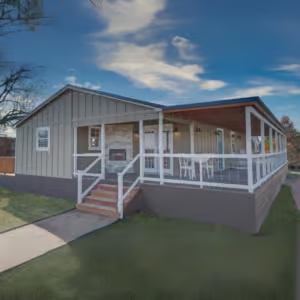

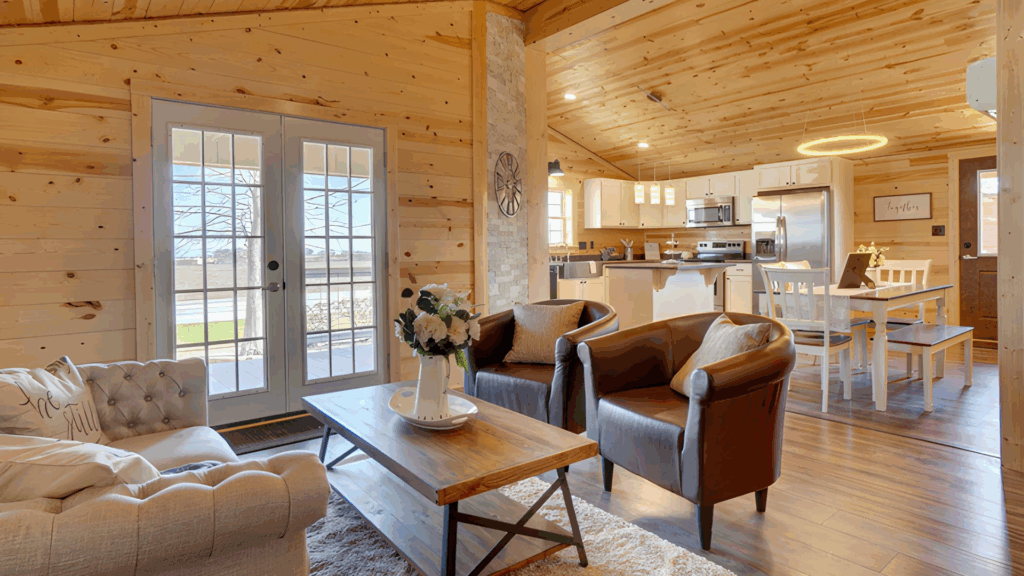

Whether you’re building your forever home, setting up a second property, or investing in a business venture, modular homes are a smart, flexible solution. And when it comes to financing your modular project, there are a few solid options depending on your total budget and timeline.

Financing a Modular Home as a Primary or Secondary Residence

If you’re planning to live in your modular home full-time or use it as a vacation property, your best option may be a one-time close construction loan through a reputable lender. This is the most popular route for buyers financing the full project.

With a one-time close construction loan, you can finance:

- The modular home itself

- Foundation work

- Land prep and clearing

- Utilities such as well, septic, water, or power hookups

- Decks, porches, and other site-built features

These loans typically convert into a 15- or 30-year mortgage once the project is complete and are available based on approved credit. If your total financing needs exceed $150,000, this is often the most streamlined and cost-effective option.

If your project total is under $150,000, your best options may include a cash purchase, or exploring short-term personal loans or a home equity line of credit (HELOC). These are quicker to secure and ideal for smaller builds, rental units, or secondary vacation cabins.

Need help navigating your options? Your sales rep can walk you through what’s available based on your credit and financial goals.

Recommended Personal Lender:

We highly recommend working with Bill Herceg, Vice President at The Federal Savings Bank. He specializes in modular home lending and has helped many of our customers successfully finance their homes.

Financing a Commercial Modular Building: Turn Your Business Dreams into Reality

Embarking on the exciting journey of establishing or expanding your commercial venture can be both thrilling and challenging. At Leland’s Modular, we’re not just about constructing versatile commercial structures for your business needs; we’re dedicated to bolstering your entrepreneurial spirit. Whether you’re planning hospitality accommodations, office spaces, retail locations, educational facilities, or any other professional venture our preferred lending partners are on standby, eager to help move your vision forward with tailored financing solutions designed to ensure the flourishing of your business.

Comprehensive Financing Solutions for Every Scale

Our network of trusted lending partners offers flexible financing options to match your project’s scope and timeline. From smaller equipment purchases starting at $10,000 to large-scale campground developments up to $50 million, we have partners who specialize in various commercial financing needs. Whether you’re looking for SBA loans, equipment financing, USDA loans, or conventional lending options, our partners provide coverage across all 50 states with competitive terms and streamlined approval processes.

Streamlined Process, Expert Support

Recommended Commercial Lenders:

Kevin Van Wagner

509-630-8720

www.fullcirclellc.us

1-888-533-4882

www.startuploansusa.com

Drew Sikula

312-224-8965

www.thebscgroup.com

Gary Raffensberger

954-494-5944

www.businessfinancedepot.com

If you’re not sure where to begin, contact us today. We’re here to help you find the right financing solution for your modular home—whether it’s a cozy lakeside cabin, a family home in the country, or a vacation rental you plan to grow.